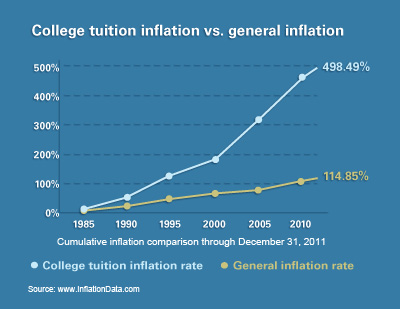

The cost of attending college in the United States has reached high financial levels never seen before, leaving students and their families struggling to cover the costs of higher education. During the last several decades, tuition prices have grown at a pace much faster than inflation. College tuition costs in the 1980s ranged from $3,225 – $8,396 yearly, today that number is multiplied by ten, stretching from $30,000 to $80,000.

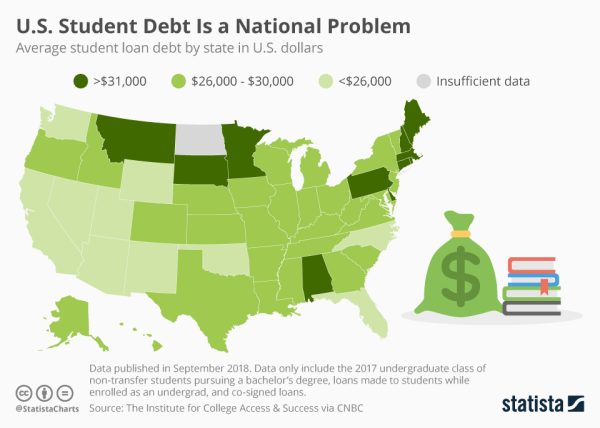

What was once a pathway to opportunity has become a heavy financial burden for millions of Americans. Today, the total student loan debt in the United States stands at a whopping $1.75 trillion, which surpasses the amount of credit card and auto loan debt combined. That number puts into perspective how challenging it is for students to pay for their education.

The rising costs of tuition make it increasingly difficult for many people to pursue higher education, forcing them to make tough decisions, such as delaying their education or taking on excessive debt that haunts them for decades.

The result is a system where access to education is unequal, and financial barriers prevent many from realizing their potential. The first step in trying to solve this growing crisis is to examine the root causes of why college tuition has become so unaffordable.

Why is college tuition so expensive?

Explanations for increasing tuition prices in college are complex, involving both economic and institutional factors. Federal financial aid, while intended to help students, has unintentionally contributed to rising costs. If colleges know students can get financial aid to pay tuition, then they have an incentive to raise their prices, knowing the financial aid will make up the difference. This has created a cycle in which increased aid feeds higher tuition, which in turn demands even more aid.

Another major force has been the growing demand for higher education. Since the GI Bill after World War II opened college to millions, the number of students seeking degrees has risen dramatically. By the 1980s, demand reached new heights, and colleges responded by expanding enrollment. However, growing demand has enabled them to increase the price, realizing that students are feeling compelled to acquire degrees to compete in the job market.

An additional contributor is the way colleges utilize their resources. Most schools spend too much on luxurious facilities and non-essential amenities, such as elaborate dorms, upscale sports complexes, and recreational centers which in turn inflate the cost.

An example of an institution renovation that increased tuition prices is Texas A&M’s construction of modern student housing. In recent years, they invested over $485 million in this project to provide unnecessary luxury features such as private bedrooms, high-end gyms, and resort-style swimming pools.

While these projects aim to attract more students, the cost of these amenities is often passed on to students through higher tuition and fees.

All these combined factors explain that high tuition costs are not only about education but also about priorities within the institutions.

Is the high price of tuition worth the return?

College in the US is marketed to enhance a student’s education, well-roundedness, and the prospect of attaining a well-paying job – but is it worth the cost? According to Forbes, average college tuition in America has more than doubled in the past two decades, pushing countless students and families nationwide into financial distress.

The dream of higher education, widely regarded as the most reliable path to success, has now become a financial nightmare. Yet while tuition rates climb at alarming rates, the sacrifices made based on the promises of financial stability and high-paying careers remain oftentimes unfulfilled.

If higher education is to maintain its relevance and purpose, the troubling disparity between the cost and value of a college degree demands greater attention and resolve.

The increasingly uncertain return on investment (ROI) for a college degree has undermined its appeal as a sure path to financial success post-graduation.

Historically, degree holders made significantly higher earnings than those without degrees, but this wage gap has stagnated in recent years.

In fact, according to Time, 45% of people holding college degrees in 2024 are taking on jobs that don’t actually require a bachelor’s, a five percent increase from 2022.

Additionally, the bottom-fourth of college graduates now earn less than they did two decades ago. To add to the disparity, wages for many professions have not kept pace with the rising cost of tuition; the National Center for Education Statistics shows that while tuition has increased by over 200% since 1980, median wages for college graduates have stagnated.

This imbalance between education and employment suggests that the return on investment for a college degree is far from assured; degree holders are earning less than their expensive education has promised.

The impact of degree inflation: Is a bachelor’s the bare minimum?

While degree holders face the increasingly poor economic value of a degree, they also are troubled by the phenomenon of degree inflation post-graduation. This new development exacts a trend of jobs that once required only a high school diploma now demanding a college degree as a prerequisite.

A Harvard Business School study showed that 37% of job postings for executive assistants–a role that previously had not required a degree–now list a bachelor’s degree as a prerequisite. What does this mean for the value of a degree? Instead of it being regarded as a mark of advanced skill and knowledge, it is now widely regarded as only a baseline qualification.

This shift forces individuals to pursue expensive degrees for roles where education is not necessarily relevant or required. Not only is this a disservice to the degree holder, but to businesses as well. According to Time, “Managers pay more for college grads yet they ultimately find that experienced employees without degrees perform just as well.” If the true purpose of higher education is advanced skill and qualification, then its role in our current society is distorted and devalued, questioning its worth in being pursued at all.

The Burden of Debt & Trouble With Financial Aid

One of the most glaring and troubling consequences of high tuition costs is the incredible debt that students and families are forced to shoulder.

Student loan debt has tripled in the US since the turn of the century, becoming a rising crisis that weighs heavily on the overall value of college education.

This debt represents not just a number, but a massive strain that impacts every aspect of a graduate’s life.

Exiting college with such debt ultimately can undermine a graduate’s ability to build a stable future.

Milestones such as purchasing a home or starting a business are consequently being delayed. This goes without mentioning the psychological toll of student debt, as the long-term payment, which can oftentimes continue through retirement, can contribute to stress, anxiety, and a deteriorated quality of life.

Addressing the Crisis

Fixes to the problem of tuition inflation have to be made both in colleges and in government policy. Colleges have to take steps to reduce wasteful spending and refocus their budgets on programs that benefit the students directly. Projects that are not essential should take a backseat to investments in academic programs, scholarships, and resources that actually enhance learning outcomes.

If institutions were to cut back on some of the amenities such as state-of-the-art recreational centers and luxury dorms, costs for students would be significantly reduced. Simultaneously, state governments need to rise to the occasion and reinstate public funding for higher education.

For students starting their college process who are worried about high costs, a cheaper alternative route would be to attend community college for the first two years and then transfer to a four-year university. This will save thousands of dollars while still achieving goals.

While these steps will not solve every part of the problem quickly, they represent real progress toward making college more affordable and accessible to all. Higher education should be an investment in the future, not a financial burden that lasts a lifetime.

Sources Utilized:

https://www.statista.com/study/72526/the-student-debt-crisis-in-the-us/

https://www.cnn.com/2023/07/16/investing/curious-consumer-college-cost/index.html

https://time.com/7010154/college-degree-inflation-essay/?

https://www.edvisors.com/blog/high-cost-of-college/